Reference module: Analyzing customer distribution using Pega Value Finder.

Myco, a telco, is working on implementing a project in which post-paid offers are presented to qualified customers. In the build stage of the ideation, the business wants to look for new opportunities to improve marketing. As a Decisioning Consultant, which simulation do you run to meet the requirement?

A bank has chosen an email service provider to deliver the offer messages selected by Pega Customer Decision Hub. The service provider prefers that the bank uploads a file per batch of customers to a cloud storage location, either on Microsoft Azure or Amazon S3. As a consultant working on the project representing the bank, what is your response?

U+ Bank wants to introduce a new group of offers called Credit cards for all customers. As a decisioning consultant, which two valid actions do you create? (Choose Two)

Reference module: Sending offer emails

What is best practice for designing an action flow?

Reference module: Creating engagement strategies using customer credit score.

MyCo, a mobile company, uses a scorecard rule in a decision strategy to compute the postpaid credit limit for a customer. MyCo updated their scorecard to include a new property in the calculation: customer annual income.As a Strategy Designer, what changes do you need to make to the decision strategy for the updated scorecard to take effect?

When a customer is offered an action that they already accepted, this is because_________.

As a Decisioning consultant, you are tasked with running an audience simulation to test the engagement policy conditions. Which statement is true when the simulation scope is: Audience simulation with engagement policy and arbitration?

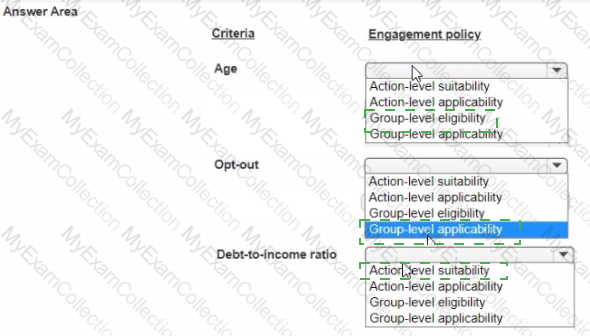

U+ Bank decides to introduce a credit cards group by leveraging the Next-Best-Action capability of Pega Customer Decision Hubâ„¢ The bank wants to present the credit card offers through inbound and outbound channels based on the following criteria.

1 Customers must be above the age of 18 to qualify for credit card offers

2. The site offers credit cards only if customers do not explicitly opt-out of any direct marketing for credit cards.

3. The Platinum Card one of the credit card offers, is suitable for customers with debt-to-income ratio < 45

As a decisioning consultant, how do you implement this requirement? In the Answer Area, select the correct engagement policy for each criterion.

U+ Bank, a retail bank, wants to begin promoting credit card offers via email to qualified customers. The business would like to ensure that the outbound run always uses the latest customer information.

What do you configure to implement this requirement?

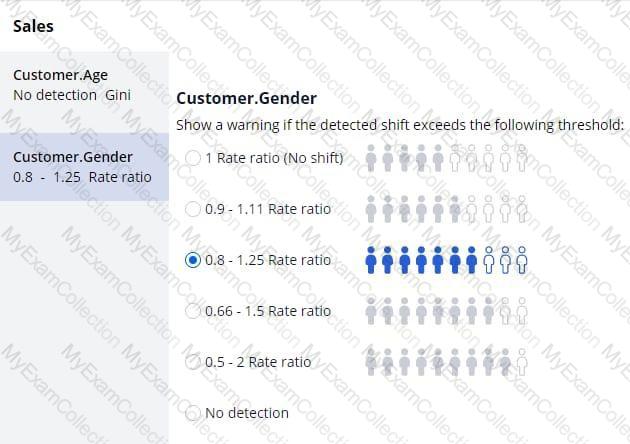

Reference module: Detecting unwanted bias

MyCo, a telco, has introduced mobile data packages for students. As a policy, MyCo does not want to discriminate based on gender when presenting the offers. As a Decisioning Consultant, how do you configure the ethical bias policy to allow no bias?

U+ Bank, a retail bank, wants to include offer related images in the emails that they send to their qualified customers. As a decisioning consultant, what best practice must you follow to include images in the emails?

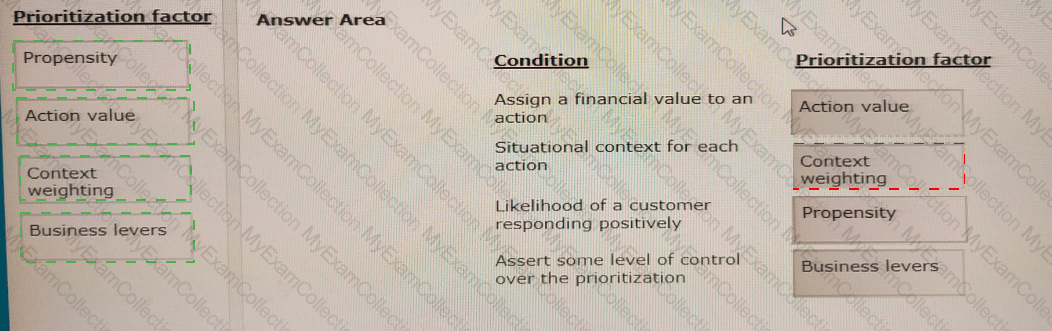

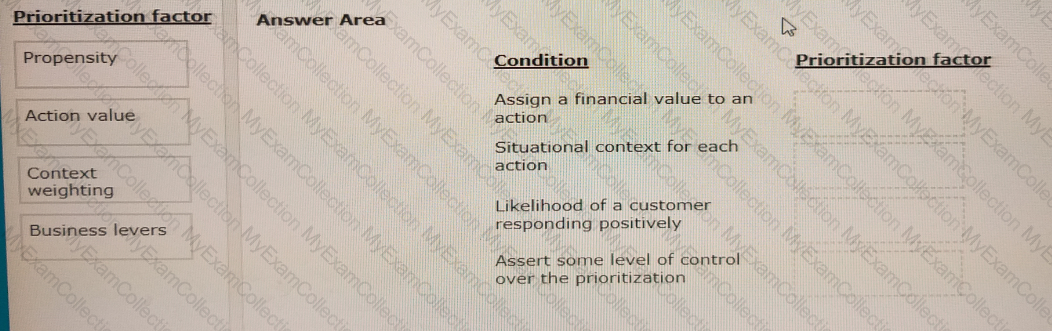

You are a decisioning consultant responsible for configuring offer prioritization for home loan offers based on the business requirements.

Select each prioritization factor on the left and drag it to the correct condition on the right.

A marketer created a segment as the starting population for the outbound schedule. In Options and Schedule, she enabled the Refreshable Segment option. What does this option do?

Reference module: Testing engagement policy conditions using audience simulation.

U+ Bank, a retail bank, recently implemented a project in which credit card offers are presented to qualified customers when the customers log in to the web self-service portal. The bank now plans to amend its engagement policy conditions. As a Decisioning Consultant, which simulation do you run to check if the conditions are too broad or narrow for your requirements?

Reference module: Sending offer emails

U+ Bank currently uses Next-Best-Action Designer to manage 1:1 customer engagement in the web channel. The bank would like to promote the same offers in email. Which two additional configurations are needed in Next-Best-Action Designer to promote the offers in email? (Choose Two)

A bank wants to sell more mortgages in the fourth quarter and is willing to offer mortgages even in situations where a credit card may have created more value. Which arbitration factor do you configure to implement this requirement?

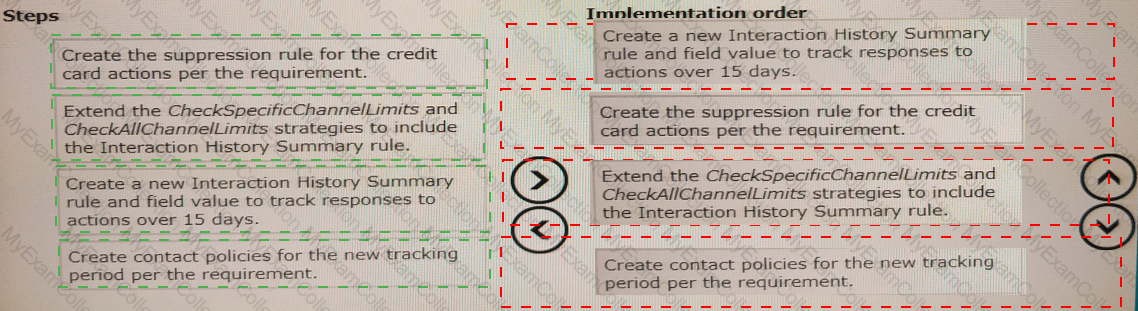

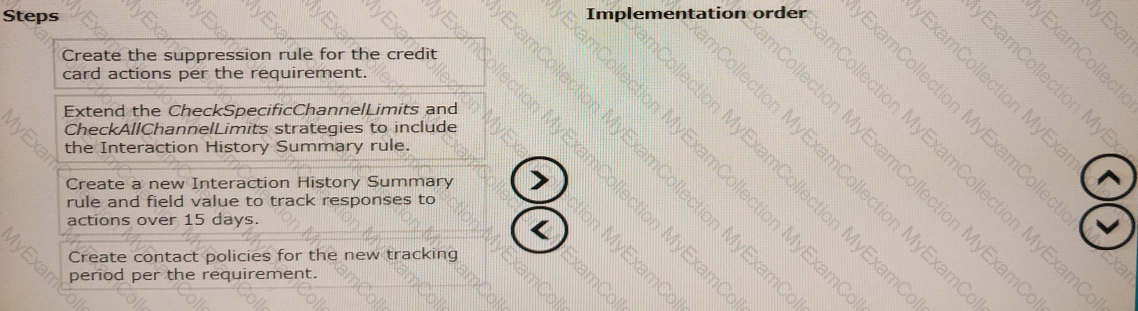

A financial institution wants to add a new tracking period to track its customers' response over 15 days in various channels. Once the response is tracked, they want to suppress the credit card actions if customers ignore it three times within 15 days.

Put the steps in the correct order to implement this task.

Reference module: Adding more tracking time periods for contact policies

A bank is currently displaying a group of mortgage offers to its customers on their website. The bank wants to suppress the mortgage group for 15 days if a customer ignores three offers from the mortgage group. How do you define the suppression rule for this requirement?

U+ Bank has decided to nudge the Platinum Plus credit card to customers who visit their home page. Which arbitration factor do you configure to implement this requirement?

For a limited time period, a bank wants to avoid sending promotional emails related to credit card offers to a customer if they have already received one. Which rule do you need to define to implement this business requirement?

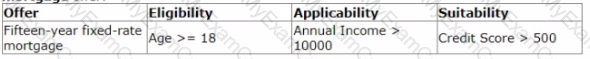

U+ Bank, a retail bank, has recently implemented a project in which qualified customers see mortgage offers when they log in to the web self-service portal.

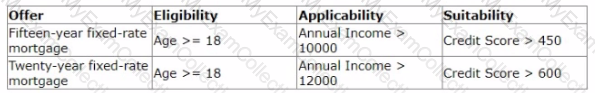

Currently, only the customers who satisfy the following engagement policy conditions receive the Fifteen-year fixed-rate mortgage offer:

The bank decides to make two changes:

1. Update the suitability condition for the Fifteen-year fixed-rate mortgage offer.

2. Introduce a new offer, Twenty year fixed-rate mortgage.

The following table shows the new engagement policy conditions for both mortgage offers:

What is the best practice to fulfill this change management requirement in the Business Operations Environment?

Which two of these statements are true about creating segments? (Choose Two)

As a Decisioning Consultant, you are tasked with configuring the ethical bias policy. Which context do you need to select to add bias fields?

Reference module: Creating engagement strategies using customer credit score.

MyCo, a mobile company, uses a scorecard rule in a decision strategy to compute the postpaid credit limit for a customer. MyCo updated their scorecard to include a new property in the calculation: customer annual income. As a Strategy Designer, what changes do you need to make to the decision strategy for the updated scorecard to take effect?

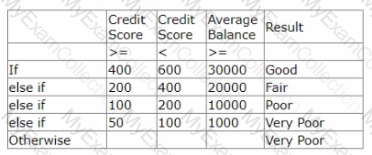

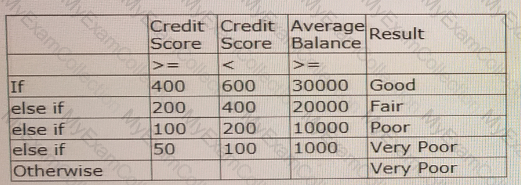

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hubâ„¢.

In addition to the credit risk requirement, U+ Bank wants to offer credit cards to customers whose age is greater than 25.

As a best practice, which part of Customer Decision Hub do you access to ensure that credit cards are offered only to customers with age greater than 25?

A volume constraint is configured to apply constraints to actions as a group rather than for each action individually. A customer qualifies for 3 actions, and the volume limit on the top-ranked action is above zero, the limits on the 2 lower-ranked actions have been reached. Given this scenario, how many actions will be selected for the customer in the outbound run?

U+ Bank has recently implemented a cross-sell on the web microjourney and is satisfied with the results. The bank now wants these Next-Best-Action recommendations to be delivered via outbound communication channels. Select two outbound channels that U+ bank can use to deliver Next-Best-Action recommendations. (Choose Two).

U+ Bank, a retail bank, presents various credit card offers to its customers on its website. The bank uses artificial intelligence (AI) to prioritize the offers based on customer behavior. Since introducing the Gold credit card offer, the offer click through rate propensity has increased to 0.83.

What does the increase in the propensity value most likely indicate?

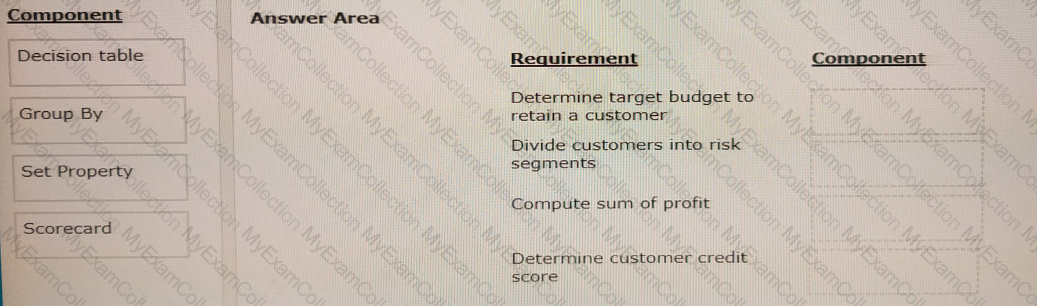

You are a strategy designer on a next-best-action project and are responsible for designing and implementing decision strategies.

Select each component on the left and drag it to the correct requirement on the right.

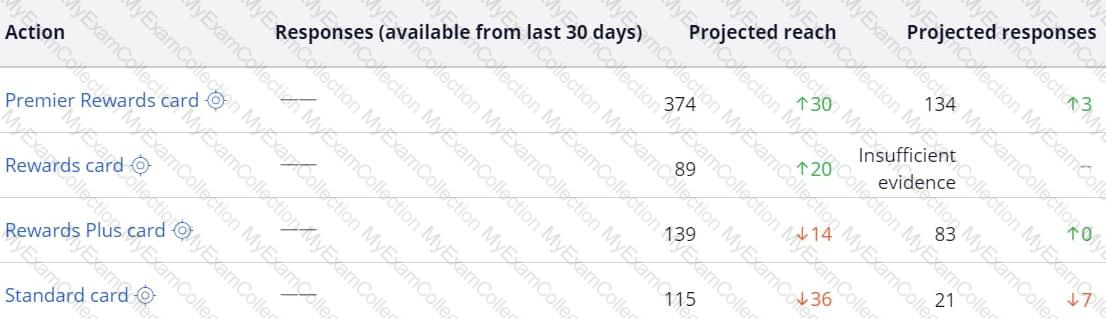

U + Bank, a retail bank, has applied business weight to their credit card offers to manually nudge the offers. The bank analyzes the effect of the change in Scenario Planner. The following image shows the projected reach and responses of the cards in the comparison mode. How many customers are likely to accept the Standard card?

To access a property from an unconnected component, you use the____________.

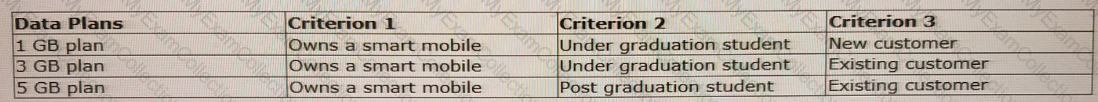

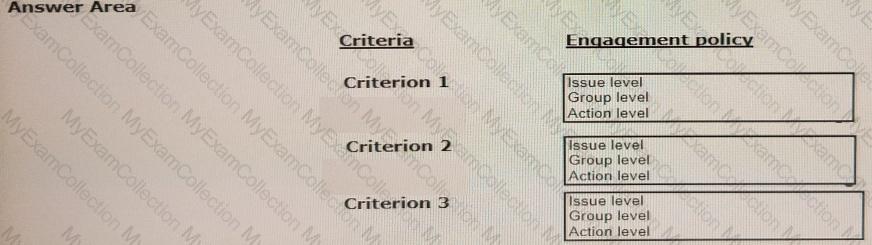

Myco, a telecom company, has come up with a new data plan group to suit its customers' needs. The below table lists the three data plan actions and the criteria a customer should satisfy to qualify for the offer.

How do you configure the engagement policies to implement this requirement?

A bank developed a scorecard to automate the loan approval process. In a decision strategy, how do you use the raw score value computed by the scorecard?

Reference module: Creating and understanding decision strategies

In a Prioritize component, the top action can be determined based on the value of ________ .

Reference module: Testing engagement policy conditions using audience simulation

U+ Bank, a retail bank, recently implemented a project in which mortgage offers are presented to qualified customers when the customers log in to the web self-service portal. As one of the offers is not performing well, the business wants to understand how many customers qualify for the offer. As a Decisioning Consultant, which simulation do you run to check how many customers qualify for an action?

U+ Bank wants to use Pega Customer Decision Hubâ„¢ to display a credit card offer, the Standard Card, to every customer who logs in to the bank website.

What three of the following artifacts are mandatory to implement this requirement? (Choose Three)

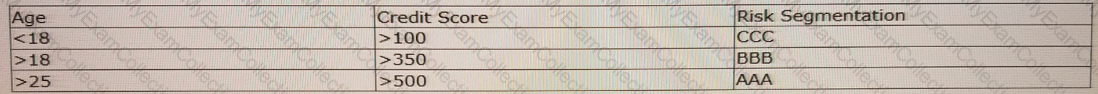

U+ Bank wants to offer credit cards only to customers with a low-risk profile. The customers are divided into various risk segments from AAA to CCC. The risk segmentation rules that the business provides use the Age and the customer Credit Score based on the following table. The bank uses a scorecard model to determine the customer Credit Score.

As a decisioning consultant, how do you implement the business requirement?

U+ Bank, a retail bank, wants to send promotional emails related to credit card offers to their qualified customers. You have already created an action flow template with the desired flow pattern and reused it for all the credit card actions.

What must you do to ensure that this action is not selected for any customers?

U+ Bank, a retail bank, wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

Reference module: Analyzing the effect of business changes using Pega Scenario Planner.

Myco, a telco, has recently implemented a project in which data plan offers are presented to qualified customers. Myco wants to understand the impact to revenue if the business introduces a new data plan offer. As a Decisioning Consultant, which simulation do you run to meet the requirement?

A bank is currently doing cross-sell on the web by showing various credit cards to its customers. Due to the credit limits of each card, the bank wants to present credit cards only to suitable customers who have a credit score greater than 500. Which component helps you to calculate a customer’s credit score?

Reference module: Next-Best-Action in an omnichannel environment

A bank uses Pega Customer Service in its contact center. When a call comes in, it is routed to a service representative. Once the service representative accepts the call, the Customer Decision Hub (CDH) determines the Next-Best-Action to be offered to the customer. What two pieces of information is used by the Customer Decision Hub to determine the Next-Best-Action recommendations? (Choose Two)

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hubâ„¢.

Which property allows you to use the risk segment computed by the decision table in the decision strategy?

Reference module: Analyzing customer distribution using Pega Value Finder.

As a Decisioning Consultant, you have just implemented a project to present mortgage offers to customers on their self-service portals. The bank asks you to pull data on the distribution of the offers to well-engaged, under-engaged, or not-engaged customers. Which simulation do you run to get the required information?

MyCo, a mobile company, uses Pega Customer Decision Hubâ„¢ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning consultant, what must you do to present offers from the two groups?

MyCo, a mobile company, uses Pega Customer Decision Hubâ„¢ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning consultant, what do you configure to select the best offer from both groups based on customer behavior?

Myco, a telecom company, uses Pega Customer Decision Hubâ„¢ to present offers to qualified customers. The business recently decided to send offer messages through the email channel. The Design department has designed an email treatment which includes dynamic placeholders.

As a decisioning consultant, what do you use in order to test the visualization and the rendering of the email content, including replacing of the placeholders with customer information?

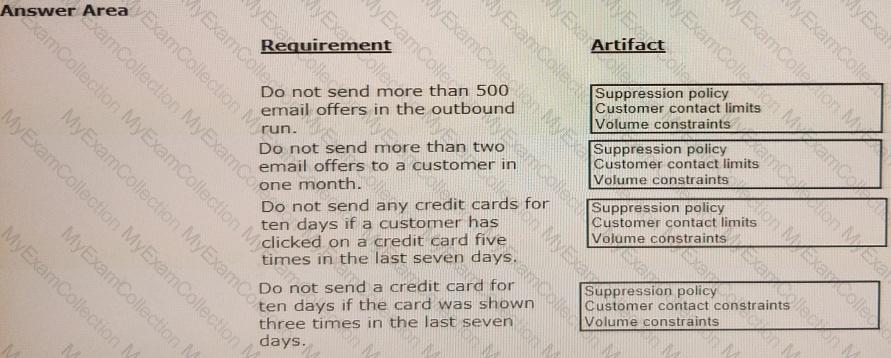

U+ Bank's marketing department currently promotes various credit card offers by sending emails to qualified customers. The bank wants to limit the number of offers that customers can receive over a given period of time.

In the Answer Area, select the correct artifact you use to implement each requirement.

Reference module: Analyzing customer distribution using Pega Value Finder Which two of the following statements are true about Value Finder? (Choose Two)

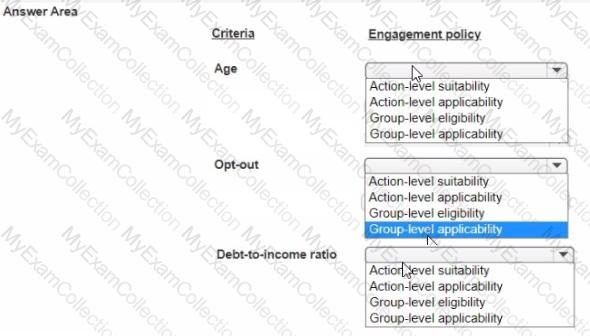

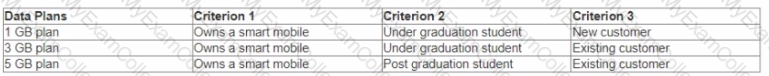

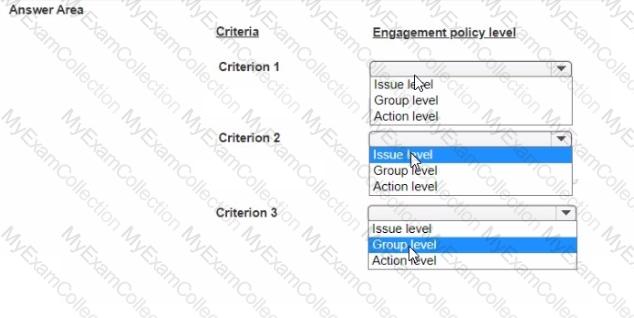

MyCo, a telecom company, developed a new data plan group to suit the needs of its customers The following table lists the three data plan actions and the criteria that customers must satisfy to qualify for the offer:

How do you configure the engagement policies to implement this requirement? Choose the engagement policy level that is best-suited for each criterion.

In a decision strategy, you can use aggregation components to_______________.