Examples of positive active listening through body language include all of the following actions EXCEPT:

Documentation on legislative changes to Forms W-2 and W-3 is initiated by which of the following organizations?

Which of the following forms of identification CANNOT be used in Section 2 of Form I-9?

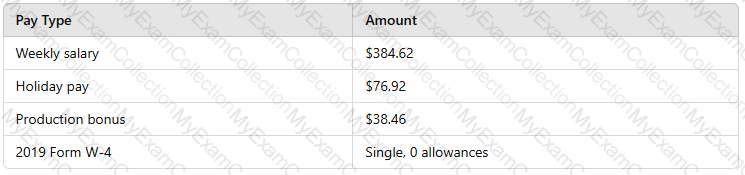

Using the percentage method for automated payroll systems, calculate the federal income tax withholding based on the following information:

A company has engaged an individual to write a sales contract. The individual receives a flat amount for the task and has an assigned time frame for completion. This individual is classified as a(n):

Which of the following simulations would NOT be performed when testing a disaster recovery plan?

An employee clocked in for work at 8:07 a.m. and out at 4:08 p.m. According to the DOL policy on rounding work hours, which of the following recorded hours are CORRECT?

When an employee fails to cash a payroll check and the employer cannot locate the employee, the Payroll Department should:

All of the following activities are examples of an internal control EXCEPT:

Using the following information, calculate the social security tax to be withheld.

An employee has YTD wages in the amount of $250,000.00 and receives a $1,753.00 bonus payment. Using the optional flat rate method, calculate the federal income tax withholding from the bonus payment.

Which of the following documents listed on Form I-9 can be used to establish both an employee's identity and employment eligibility?

An employee has received $169,000.00 in YTD earnings. The employee receives a payment of $16,600.00. The employer Medicare tax, if any, is:

During open enrollment, the employee elects the following deductions. What is the total of the Section 125 Cafeteria Plan deductions?

To reconcile a general ledger tax liability account balance, verify all of the following items EXCEPT:

All of the following criteria are used to determine FMLA eligibility EXCEPT the number of:

Employers who properly repay over-withheld amounts to employees can claim a credit against taxes due by making an adjustment on:

Failure to create a payroll ACH file is a violation of which customer service principle?

Even if a worker meets the definition of an employee, an employer can still treat the worker as an independent contractor if the worker passes the:

Payroll standard operating procedures should be updated no less frequently than:

Using the following information from a payroll register, calculate the tax deposit liability for the payroll.

Which account type is used to classify accrued, but not yet taken, paid leave that is carried over from one year to the next?

When an employer engages with a leasing company to lease an employee, the employer does NOT:

Using the following information, calculate the employer's total FICA tax liability for the first payroll of the year.

Which of the following data elements is needed to calculate an employee’s net pay from gross pay?

When resolving late deposits, the payroll staff should take all of the following steps EXCEPT:

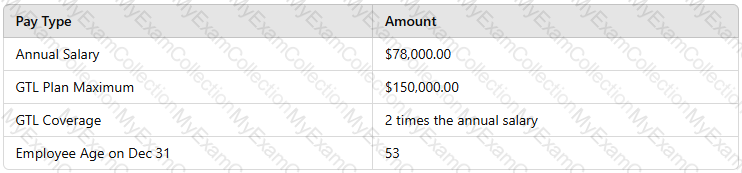

Using the following information, calculate the imputed income that MUST be included in the employee’s monthly gross pay.

All of the following preventative measures would help protect personally identifiable information EXCEPT:

The monthly account reconciliation should include all of the following procedures EXCEPT:

An employee has $240,000.00 in YTD taxable wages and receives a taxable fringe benefit of $2,500.00. Calculate the Medicare and FITW using the optional flat rate method for the taxable fringe benefit.

Using the wage bracket method, calculate the employee’s net pay. The employee’s W-4 was completed in 2019 or earlier.

Which of the following awards are included in an employee's taxable income?