Quintin has been a Dealing Representative for Global Maximum Financial for 5 years. Today, he opened an account for his new client, Reginald. In addition to opening a new account, Reginald agreed to

accept Quintin's investment recommendation and placed a purchase order to buy units of the Global Maximum Value Equity fund.

Quintin informed his Branch Manager Lupita about this new account on the same day the purchase order was received. Lupita told Quintin that she would complete her review of the New Client Application

Form (NCAF) by no later than tomorrow.

Which statement regarding this new account opening is CORRECT?

Which of the following qualifies as personal information under the Personal Information Protection and Electronic Documents Act (PIPEDA)?

Terri, 30 years old, is the marketing manager at Provincial Winery with an average annual income of $60,000. Her spouse Yvette, 28 years old, is a project manager with a telecommunications firm earning

$70,000 per year. You are helping them to organize their investments and are trying to assess their financial resources.

Which of the following is the best question to ask?

Marta is turning 71 years old this year. She will have to convert her registered retirement savings plan (RRSP) to a registered retirement income fund (RRIF). Which of the following statements is TRUE?

Davis invested in a tactical asset allocation fund in his non-registered investment account. Distributions from the mutual fund are paid directly to Davis and not reinvested. Assuming a federal marginal tax rate

of 26%, dividend gross-up rate of 38% and federal dividend tax credit rate of 15%, which type of distribution would result in the lowest amount of tax payable?

Which of the following formulas correctly shows how taxable income is calculated?

Eleanora receives a $500 eligible Canadian dividend from her mutual fund. Her federal marginal tax rate for the year is 29%. Assuming the enhanced gross-up of 38% and a federal dividend tax credit of 15.02%, how much federal tax will she pay on her dividend?

Quinton, a Dealing Representative, meets with his client Banji. Banji’s Know Your Client (KYC) indicates that her risk profile is “medium’’. Banji currently has $35,000 in her account which is invested 50% in the Middleton Balanced Fund and 50% in the Hector Growth Fund. She tells Quinton that she would like to contribute an additional $10,000 to purchase the Prospect Labour-Sponsored Fund. Which of the following statements about Banji’s proposed transaction is CORRECT?

In which of the following situations would the client mobility exemption apply?

Sarah and Kyle are a married couple. They are both 34 years of age and work as teachers. Their combined annual income is $130,000. They are able to save $800 each month. They own a home worth $340,000 with a $120,000 mortgage. Since they work for the same employer, they have the same defined benefit pension plan. Other than a tax-free savings account (TFSA) in Kyle’s name with $5,000, they do not have any other assets.

They are avid sailors and want to save towards a purchase of a sailboat. For the type of sailboat they want, they estimate it should cost around $65,000. They want you to recommend an investment for their monthly savings to help them achieve their goal faster.

What question should you ask them next?

Last year at age 70, Gregory opened a registered retirement income fund (RRIF). Recently, Gregory unexpectedly received a large cash gift and presently does not need to depend on any payments from his RRIF. He contacts his financial advisor Eric for guidance.

Which of the following statements by his financial advisor would be CORRECT?

What is the national self-regulatory organization (SRO) for investment dealers?

Sheldon is a 25 year old graphic designer. He has just started working and saves regularly. Apart from his regular salary he also earns extra money from freelancing after office hours and during weekends. His earnings from his freelance work are sufficient for meeting his living expenses. He saves the entire amount of his salary. He has heard about lifecycle funds but has come to you for additional information.

Which of the following statement about lifecycle funds is TRUE?

Which statement about unused registered retirement savings plan (RRSP) contribution room is CORRECT?

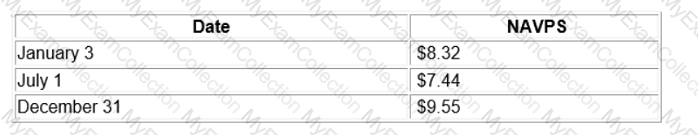

On January 3, John invests $500 in the Blue Sky U.S. Equity Fund. On July 1 of the same year, he invests another $500 into the same mutual fund. Information about the net asset value per unit (NAVPU) at the time of each transaction is provided below. Given this information, what will be the value of John's investment on December 31 of this year (please ignore transaction costs and distributions)?

Darryl has a diversified investment portfolio of mutual funds in a non-registered account with Investwell Mutual Funds, a mutual fund dealer. Darryl’s diversified portfolio is composed of 3 mutual funds. Each mutual fund is currently worth about $100,000. The ABC Canadian Equity Fund has a total return of 6%, the DEF Bond Fund has a total return of 8% and GHI Global Equity Fund has a total return of 10%. Darryl wants to make an in-kind contribution to his registered retirement savings plan (RRSP) account. He has unused RRSP contribution room of $60,000.

From a tax-efficient viewpoint, which funds contribute in-kind to his RRSP account?

Sven owns preferred shares that give him the option to sell his holdings back to the issuing company at a predetermined price and within a specified time. What type of preferred shares does Sven own?

Barend is a Dealing Representative with Planvest Group Inc., a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA). Which of the following CORRECTLY describes

Barend's obligation for conflicts of interest?

Exchange traded funds (ETFs) that track an index and index mutual funds have many similarities. However, what is a major difference between these two products?

Justin and Yvonne both open a Registered Education Savings Plan (RESP) for their daughter Grace. They plan to regularly contribute $1,000 per year until Grace reaches the age of 17.

Which of the following statements relating to RESP is CORRECT?

Charlotte has received proceeds from a deceased family member’s estate. Charlotte decides to visit Malik, who’s a Dealing Representative at her bank. She tells Malik, she does not know much about trading ETFs, but she wants to invest in ETFs. Charlotte says she feels fortunate to have this money and that she’s not worried about losing it because she never planned on having any of it.

What element of the Know Your Client (KYC) information has Malik been able to learn?

Danica is looking for a mutual fund to hold in her non-registered account that provides a regular stream of income with potential for capital growth. She is having difficulty distinguishing between bond funds and dividend funds. Which of the following statements is TRUE?

Which of the following statements describes a feature of the Home Buyers’ Plan (HBP)?

What type of shares offer its shareholders the opportunity to receive additional dividends if the company’s profit exceeds a stated level?

Faruq is a Dealing Representative with Smart Planning Group, a mutual fund dealer. Faruq meets with his new client, Taline, and learns that she lives on a low, fixed income.

Taline tells Faruq that she wants to maximize her investment returns as high as possible to make up the difference. Taline also indicates that she cannot afford large investment losses because her income is low. Which of the following CORRECTLY describes how Faruq should assess Taline’s risk profile?

Ken is a member of his employer’s Defined Benefit Pension Plan (DBPP). Which of the following statements about Ken’s plan is CORRECT?

Daisy is a Dealing Representative registered in the province of Saskatchewan only. Daisy’s client, Orville, a resident of Lloydminster, Saskatchewan is a retiree who presently has a $1,000,000 with her dealer, Easy Ride Financial. Orville is now planning to move to Vegreville, Alberta next month. Easy Ride Financial is registered in Alberta and Saskatchewan. Neither Easy Ride Financial nor Daisy have any clients who are resident in Alberta.

Which of the following should Daisy do if she wants to continue to service Orville’s account?

With respect to the tax treatment of dividends received from a taxable Canadian corporation, which of the following statements is CORRECT?

Which statement CORRECTLY describes index mutual funds and traditional exchange-traded funds (ETFs)?

Tony, the investment manager of True North Canadian Equity Fund is deciding on some new investments. He has done an economic analysis of the various provinces and sectors of the Canadian economy and has determined that Nova Scotia and Alberta present the best prospects. He has also identified potential in the oil and gas sector. He narrows down his selection to an oil supply firm in Medicine Hat and a drilling company in Halifax.

What investment approach is Tony employing?

Taylor is chatting with other parents in the park when the conversation turns to registered education savings plans (RESPs). Taylor thinks that most of what they are saying is incorrect. Which of the following

statements about self-directed RESPs is TRUE?

Patrick is a portfolio manager for the HyperTally Growth Fund. It has generated an annualized rate of return of 10% this past year. However, with the anticipation of very high inflation to soon occur, there is also an expectation of higher interest rates. Patrick is concerned about the future returns of existing stocks within the fund. What may Patrick do to protect against the market value of the fund dropping?

Based on your discussions with your client Sierra, you believe an asset allocation of 30% fixed income and 70% equities will help her achieve her long-term goals. What type of asset allocation strategy are you implementing?

Xerxes, 45 years old, is a successful architect, having an annual income of $185,000. He has around $10,000 in his non-registered account, which he is looking to invest in a tax-efficient manner.

From the following options, which would be the most tax-efficient?

What statement CORRECTLY describes a key difference between bonds and debentures?

Pierre buys a call option on a stock. What is the implication of this transaction?

Ellen and her only son Jeff live on the family farm with her father George. Jeff is five years old and Ellen has decided that it is time to start saving for Jeff’s post-secondary education. She has called you to ask about registered education savings plans (RESPs).

Which of the following statements is TRUE?

Sandra presently participates in her employer-sponsored defined contribution pension plan (DCPP). As contributions continue to be made into her plan, what can she expect?

Sylvia decided to use the savings from her bank account to purchase a 5-year bond. The face value of the bond is $10,000, the market price is $9,230 and the coupon rate is 7%.

What is the current yield on the bond? Round to 2 decimal places.

Saheed is a retiree who is considering splitting his pension income with his wife, Minu.

Which of the following outcomes may occur if he shares his pension benefits?

Your client Charlie is thinking about making a large investment into the Sentinel Canadian Equity Fund on December 15. The ex-dividend date for the mutual fund is December 20. What advice would you give

Charlie to avoid the tax trap?

Sachin owns units of a long-term bond fund. He has heard that the Bank of Canada is likely to make it more expensive to borrow money. He is worried that the value of his investment is going to drop. What sort of investing risk is Sachin experiencing?