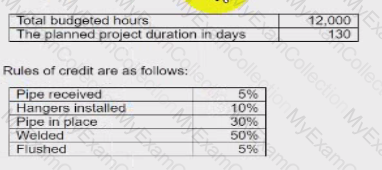

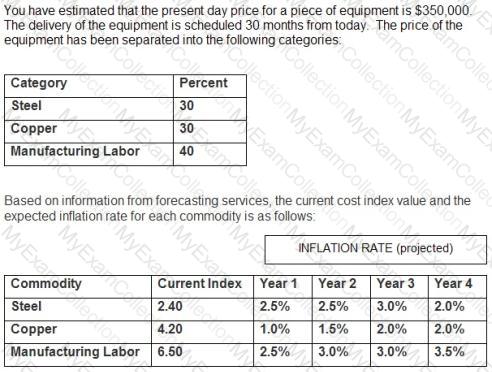

You have been hired as the cost engineer for a mechanical contractor and have been provided the following information:

What is the schedule performance index (SPI)?

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

If $20,000 is invested at the end of each fiscal year for the next 10 years, how much would our total investment be worth assuming the interest is at 10%?

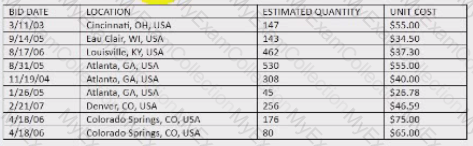

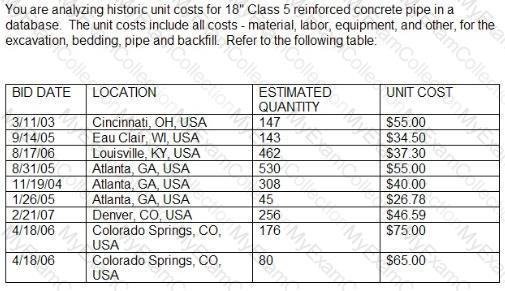

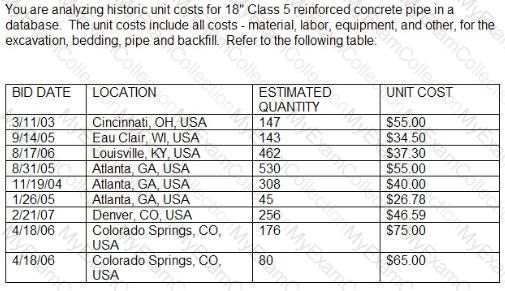

You are analyzing historic unit costs for 18'' Class 5 reinforced concrete pipe is a database. The unit costs include all costs-material, labor, equipment, and other, for the excavation, bedding, pipe and backfill. Refer to the following table:

What is the median unit cost?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

The recognition of loss of value of a natural resource used in the production process is referred to as:

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Assuming the average life span of a lithium battery is two years and is normally distributed with a standard deviation of two months, what is the probability the battery will last between 20 months and 26 months?

The following question requires your selection of CCC/CCE Scenario 6 (2.7.50.1.3) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Calculate the mean unit cost.

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

The value of the truck at the end of year five (5) would be:

The following question requires your selection of Scenario 1.4.150 from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Annual depreciation (in USS) would be calculated as follows for a capital recovery with salvage analysis:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Depreciation (in the United States) is calculated in accordance with which of the following?

After collecting the control information on a light rail project within an original budget of 200.000work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor Is 60%.

What is the schedule variance (SV)?

The purpose of a communication must be understood by ____________ if the message is to be clear to the

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

The taxable income in year number 5 is:

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

The following question requires your selection of CCC/CCE Scenario 26 (2.5.50.1.2) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Why is a +/- notation necessary when developing an estimate?

The following question requires your selection of CCC/CCE Scenario 4 (2.7.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

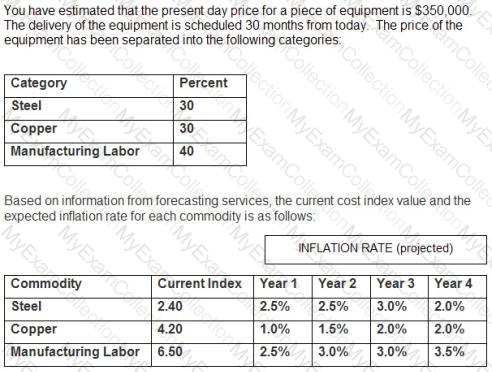

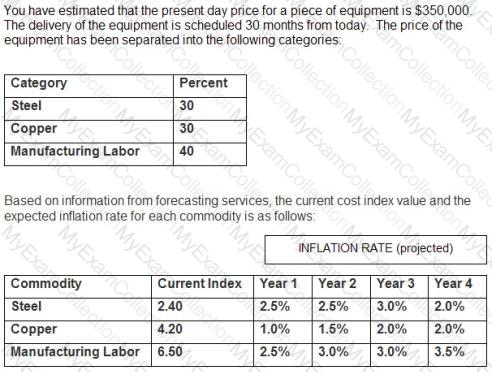

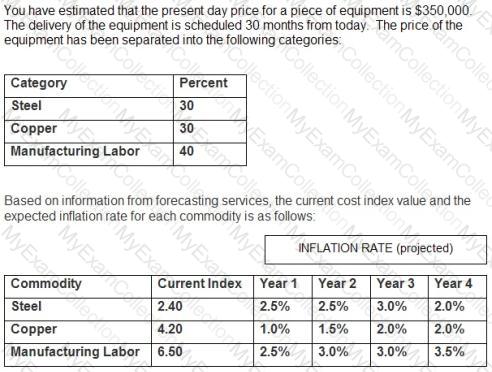

What is the cost of manufacturing labor for the piece of equipment today?

What is executed in connection with a contract and secures the performance and fulfillment of all the undertakings, covenants, terms, conditions and agreements contained in the contract?

An effort by a prime contractor to reduce the price quoted by a vendor, by providing the bid price to other vendors in an attempt to get the other vendors to underbid the original price quoted is referred to as:

Productivity increases with time. This improvement is commonly associated with improvements in efficiency brought about by increased experience and skill levels. What does this scenario describe?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

The compound interest factor used to determine Present Value in year number 5 is:

AACE International defines _____________as a technique of economic evaluation that sums over a given study period, the costs of initial investment, replacements, operations, and maintenance/repair; expressed in either present or annual value terms.

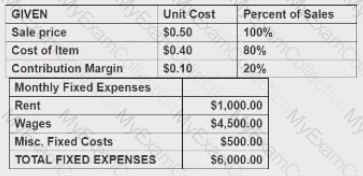

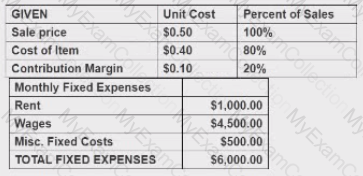

As the leas cost engineer for the XYZ Services Company, you have been requested to provide pertinent for an equipment rental decision. The unit price of the food stuffs varies, but an average unit selling process has been determined to be $0.50 cents and the average unit acquisition cost is $0.40 cents.

The following revenue and expense relationships are predicted:

If the fixed rent remains unchanged, and XYZ pays S0.01 per unit as additional rent, the monthly breakeven point in numbers of units becomes:

Cost performance index (CPI) is defined by AACE International as: (assume no change in budgeted quantities)

Which of the following are used for profitability analysis in a construction company?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

Resource planning must take all of the following into account except:

Two of the most important things to know when planning a speech or lecture are the ______________and______________ of your audience.

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

Which of the following would NOT be considered part of a project cost and schedule forecast?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

Cost engineers who feel completely satisfied and fulfilled by their work as part of a project team are said to have reached the ______________ stage of Maslow's hierarchy of needs.

If you deposit $100 per month for two (2) years and earn interest at 12% APR (Annual Percentage Rate) compounded monthly, how much will you have at the end of the period?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

A cyclical process model was chosen as the basis for total cost management (TCM) because:

The following question requires your selection of CCC/CCE Scenario 6 (2.7.50.1.3) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the relative frequency of unit costs amounting to $55.00/unit?

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

If $10,000 is scheduled to be paid out 5 years from now, what is the minimum amount we can invest today?

The following question requires your selection of CCC/CCE Scenario 4 (2.7.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the cost index value of copper at the end of Year 2? (rounded to 2 decimal positions)

When a person hears the words being said to him/her, but does not receive the message of the words, it is called

As the leas cost engineer for the XYZ Services Company, you have been requested to provide pertinent for an equipment rental decision. The unit price of the food stuffs varies, but an average unit selling process has been determined to be $0.50 cents and the average unit acquisition cost is $0.40 cents.

The following revenue and expense relationships are predicted:

It S480 is the target net profit, then the total sales volume (in dollars) is:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

All of the following are included in "income tax" calculations except:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the 25 year after tax present worth of this project?

The following question requires your selection of CCC/CCE Scenario 4 (2.7.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

At the end of Year 3, steel prices will have increased by what percentage over today's price? (round to 1 decimal)

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

What Kind of optimization modeling is used in making investment analysis to evaluate the risks associated with the potential investment?

The following question requires your selection of CCC/CCE Scenario 6 (2.7.50.1.3) from the right side of your split screen., using the drop down menu, to reference during your response/choice of responses.

Calculate the weighted average unit cost.

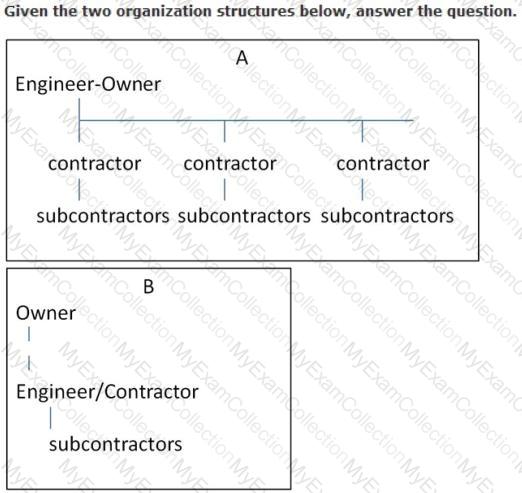

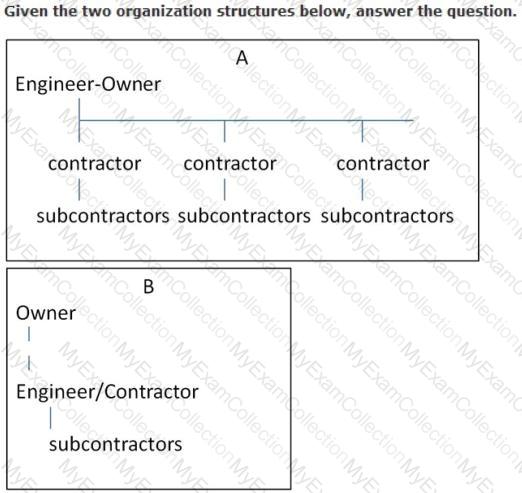

The following question requires your selection of CCC/CCE Scenario 28 (3.7.50.1.7) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

In the A relationship, the subcontractor might use an unbalance bid to:

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Based on the information provided, which statement is most correct?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

All of the following are characteristics of standard normal distribution, except:

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

In an exit interview, an employee comments that the reason he is leaving the organization is lack of teamwork and cohesion among his co-workers. Which need of Maslow's hierarchy of needs is unmet?

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

If the company needs to repay a loan of $100,000 in 10 uniform annual payments, how much will each payment be?

If a project is said to be on a "fast track program/' the fast track method is:

The following question requires your selection of CCC/CCE Scenario 28 (3.7.50.1.7) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

If the owner in A has a primary goal of completion within budget, the following contract types with the engineer/contractor would be best:

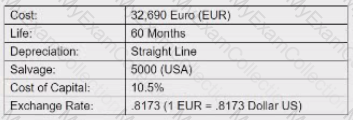

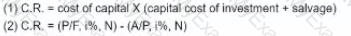

An American company plans to acquire a new press machine from a Dutch manufacturer under the following conditions. One question remaining to be answered is the expected amount of capital recovery when salvage is accounted for.

The following question requires your selection of Scenario 1.4.150 from the right side of your split screen. using the drop down menu, to reference during your response/choice of responses.

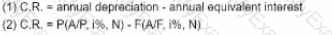

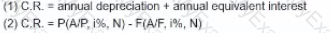

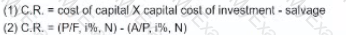

Using normally accepted engineering economic practices, what are the two expected methods that should be used to determine the capital recovery costs for the new press?

A)

B)

C)

D)

An owner advertised his villa for sale. An investor worked out an estimate on the basis mat the villa could be rented out for $1000 per month. Maintenance charges and other taxes are estimated to be $1,500 per year. The tenant has to pay all utility charges. The investor thinks that he can sell this villa for S100.000 alter 6 years. Assuming that the minimum acceptable rate of return is 12%. answer the following question.

The villa could be recommended for purchase at all of the below-mentioned prices except:

After collecting the control information on a light rail project within an original budget of 200.000 work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor Is 60%.

What is the cost variance (CV)?

SCENARIO: A can manufacturing company requested you to provide data for their decision making The unit prices of the can varies but an average selling price of $0.55 cents and average cost of S45 cents is estimated.

The monthly fixed costs are:

Rant-$1,500

Wages - $4.000

Miscellaneous fixed expenses - $500

If the rent increases by 100% and the unit sales/other costs remain unchanged, the new break even amount is?