Which of the following statements about endogenous and external types of liquidity are accurate?

I. Endogenous liquidity is the liquidity inherent in the bank's assets themselves.

II. External liquidity is the liquidity provided by the bank's liquidity structure to fund its assets and maturing liabilities.

III. External liquidity is the non-contractual and contingent capital supplied by investors to support the bank in times of liquidity stress.

IV. Endogenous liquidity is the same as funding liquidity.

The main building blocks of an operational risk framework include all of the following options EXCEPT:

Mega Bank holds a $250 million mortgage loan portfolio, which reprices every 5 years at LIBOR + 10%. The bank also has $150 million in deposits that reprices every month at LIBOR + 3%. What is the amount of Mega Bank's rate sensitive liabilities?

Which one of the following does the Basel I Accord fail to take into consideration?

Which of the following about the ratios between various Tiers of capital is not a requirement of the Basel Committee?

Alpha Bank estimates its 1-month, 95% VaR is 30 million EUR. This means that in the next month, there is a

James Johnson bought a 3-year plain vanilla bond that has yield of 4.7% and 4% coupon paid annually, for $87,139. Macauley's duration of the bond is 2.94 years. Rate volatility is 20% of the yield. The bond's annualized volatility is therefore:

What is the order in which creditors and shareholders get repaid in the event of a bank liquidation?

The probability of default on a bond is 3%, and in the case of default, investors expect to lose 70% of their investment. The bond's risk premium is 1.9%. The expected loss and the credit spread of the bond are, respectively:

Banks duration match their assets and liabilities to manage their interest risk in their banking book. A bank has $100 million in interest rate sensitive assets and $100 million in interest rate sensitive liabilities. Currently the bank's assets have a duration of 5 and its liabilities have a duration of 2. The asset-liability management committee of the bank is in the process of duration-matching. Which of the following actions would best match the durations?

Which of the following would a bank resort to as a "lender of last resort" in the event of an extreme liquidity crisis?

For a bank a 1-year VaR of USD 10 million at 95% confidence level means that:

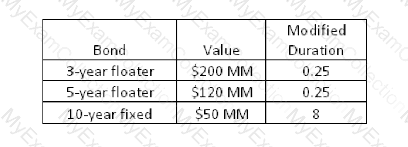

A bank owns a portfolio of bonds whose composition is shown below.

What is the modified duration of the portfolio?

An asset and liability manager for a large financial institution has to recognize that retail products ___ include embedded options, which are often not rationally exercised, while wholesale products ___ carry penalties for repayment or include rights to terminate wholesale contracts on very different terms than are common in retail products.

A customer asks a broker employed by AlphaBank to buy Eureka Corporation bonds for her account. While this trade was executed correctly and the bonds were bought, the trade was mistakenly accounted for as a sell order. If the price of Eureka Corporation bonds goes up, this trade would result in a significantly larger loss than if the market had remained stable. However, if the market drops, the customer will benefit from the incorrect accounting and gain from this trade. This trading scenario can serve as an example that

Which of the following attributes of duration gap model typically cause criticism?

I. Basis risk

II. Errors in the linear model

III. Costs of immunization

IV. Constant nature of calculation

What is a common implicit assumption that is made when computing VaR using parametric methods?

Which one of the following four statements correctly defines a typical carry trade?

Short-selling is typically associated with the following risks:

I. Potential for extreme losses

II. Risk associated with the availability of shares to borrow

III. Market behavior risk

IV. Liquidity risk

According to the principles of the Basel II Accord, the implementation and relative weights of the elements of the operational risk framework depend on:

I. The culture of the financial institution

II. Regulatory drivers

III. Business drivers

IV. The bank's reporting currency

The Basel II Accord's operational risk definition excludes all of the following items EXCEPT:

A retail credit score of above 680 is generally considered to be "prime." The term "prime" means the borrower is what?

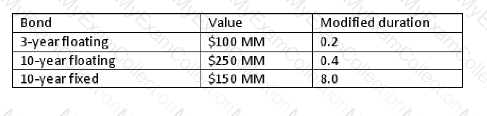

A portfolio consists of two floating rate bonds and one fixed rate bond.

Based on the information below, modified duration of this portfolio is

The exercise for an American type option prior to expiration day is virtually certain in the following case:

SigmaBank has many branches that offer the same products and services. Which one of the four following statement presents an advantage of using RCSA questionnaire approach in the SigmaBank's operational risk framework?

Which one of the following is the underlying contract for an Asian commodity option?

A bank has a large number of auto loans and would prefer to sell them to raise cash for more funding. However, selling individual auto loans is difficult. What could the bank do?

Under the Standardized Approach in the Basel II Accord, what is the risk weight of a non-performing corporate loan?

PV01 is a method of describing interest rate risk. Which one of the following is a specific weakness of PV01?

To estimate the required risk-adjusted rate of return on a highly volatile energy stock, a risk associate compiled the following statistics:

Risk-free rate = 5%

Beta = 2.5

Market Risk = 8%

Using the Capital Asset Pricing Model, she estimates the rate of return to be equal:

Which of the following statements describes correctly the objectives of position mapping ?

A key function of treasuries in commercial/retail banks is:

I. To manage the interest margin of the banks.

II. To focus on underwriting risk.

III. To ensure strong earnings.

IV. To increase profit margins.

Which among the following are shortfalls of the static liquidity ladder model?

I. The static model gives a liquidity estimate only after the bank faces the liquidity problem.

II. The static model can only make projections over a few days.

III. The static model does not incorporate uncertainty in the analysis.

Bank Omega is using futures contracts on a well capitalized exchange to hedge its market risk exposure. Which of the following could be reasons that expose the bank to liquidity risk?

I. The bank may not be able to unwind the futures contracts before expiration.

II. Prices may move such that a loss results on the hedge.

III. Since futures require margins which are settled every day, the bank could find itself scrambling for funds.

IV. Exchange margin requirements could change unexpectedly.

Which of the following bank events could stress the bank's liquidity position?

I. Maturing of bank debt

II. Repurchase agreements

III. Futures margins

IV. Staff turnover

The skewness of ABC company's stock returns equal -1.5. What is the correct interpretation of this?

Which of the following statements explains how securitization makes retail assets highly liquid and the balance sheet easier to manage?

I. The bank can raise capital by selling the securitized bonds.

II. Any need to diversify credit risk can be achieved by selling the bank’s own securitized bonds and buying other bonds that increase diversification.

III. The value of the securitization is linked to the credit rating of the bank and hence is easy to include in medium-term financial plans.

IV. Securitizations can be used to hedge credit risk by using limited market instruments.

The Sarbanes-Oxley Act includes one of the following four requirements for financial institutions in the United States:

US based Alpha Bank holds European corporate bonds and US inflation–indexed Treasury notes in its investment portfolio. This investment portfolio is not exposed to changes in which of the following?

Which one of the following statements is an advantage of using implied volatility as an input when calculating VaR?

Under Basel III, the Comprehensive Risk Measure is an incremental charge for what kind of trading portfolio?

A risk analyst at EtaBank wants to estimate the risk exposure in a leveraged position in Collateralized Debt Obligations. These particular CDOs can be used in a repurchase transaction at a 20% haircut. If the VaR on a $100 unleveraged position is estimated to be $30, what is the VaR for the final, fully leveraged position?

Which one of the following four statements correctly describes an American call option?

To estimate the interest charges on the loan, an analyst should use one of the following four formulas:

Which one of the following four statements correctly defines an option's delta?

Typically, which one of the following four option risk measures will be used to determine the number of options to use to hedge the underlying position?

As DeltaBank explores the securitization business, it is most likely to embrace securitization to:

I. Bring transparency to the bank's balance sheet

II. Create a new profit center for the bank

III. Strategically release risk capital and regulatory capital for redeployment

IV. Generate cash for additional debt origination

A risk manager is considering how to best quantify option price dynamics using mathematical option pricing models. Which of the following variables would most likely serve as an input in these models?

I. Implicit parameter estimate based on observed market prices

II. Estimates of sensitivity of option prices to parameter changes

III. Theoretical option determination based on assumptions

To hedge a foreign exchange exposure on behalf of a client, a small regional bank seeks to enter into an offsetting foreign exchange transaction. It cannot access the large and liquid interbank market open primarily to larger banks. At which one of the following exchanges can the smaller bank trade the currency futures contracts?

I. The Tokyo Futures Exchange

II. The Euronext-Liffe Exchange

III. The Chicago Mercantile Exchange

Which one of the following four models is typically used to grade the obligations of small- and medium-size enterprises?

Which one of the following four statements on factors affecting the value of options is correct?

A bank customer chooses a mortgage with low initial payments and payments that increase over time because the customer knows that she will have trouble making payments in the early years of the loan. The bank makes this type of mortgage with the same default assumptions uses for ordinary mortgages, thus underestimating the risk of default and becoming exposed to:

When a credit risk manager analyzes default patterns in a specific neighborhood, she finds that defaults are increasing as the stigma of default evaporates, and more borrowers default. This phenomenon constitutes

A credit rating analyst wants to determine the expected duration of the default time for a new three-year loan, which has a 2% likelihood of defaulting in the first year, a 3% likelihood of defaulting in the second year, and a 5% likelihood of defaulting the third year. What is the expected duration for this three-year loan?

Which one of the following four metrics represents the difference between the expected loss and unexpected loss on a credit portfolio?

Which of the following statements about the interest rates and option prices is correct?

Gamma Bank provides a $100,000 loan to Big Bath retail stores at 5% interest rate (paid annually). The loan also has an annual expected default rate of 2%, and loss given default at 50%. In this case, what will the bank's expected loss be? What is the expected loss of this loan?

A large energy company has a recurring foreign currency demands, and seeks to use options with a pay-off based on the average price of the underlying asset on either a few specific chosen dates or all dates within a specific pricing window. Which one of the following four option types would most likely meet these specific foreign currency demands?

A credit analyst wants to determine a good pricing strategy to compensate for credit decisions that might have been made incorrectly. When analyzing her credit portfolio, the analyst focuses on the spreads in each loan to determine if they are sufficient to compensate the bank for all of the following costs and risks EXCEPT.

Which one of the following four statements does identify correctly the relationship between the value of an option and perceived exchange rate volatility?

When trading exotic options, one needs to consider the following risks:

I. Spot foreign exchange risks

II. Forward foreign exchange risks

III. Plain vanilla options risks

IV. Option-specific risks

A credit risk analyst is evaluating factors that quantify credit risk exposures. The risk that the borrower would fail to make full and timely repayments of its financial obligations over a given time horizon typically refers to:

ThetaBank has extended substantial financing to two mortgage companies, which these mortgage lenders use to finance their own lending. Individually, each of the mortgage companies has an exposure at default (EAD) of $20 million, with a loss given default (LGD) of 100%, and a probability of default of 10%. ThetaBank's risk department predicts the joint probability of default at 5%. If the default risk of these mortgage companies were modeled as independent risks, what would be the probability of a cumulative $40 million loss from these two mortgage borrowers?

When looking at the distribution of portfolio credit losses, the shape of the loss distribution is ___ , as the likelihood of total losses, the sum of expected and unexpected credit losses, is ___ than the likelihood of no credit losses.

Which of the following factors would typically increase the credit spread?

I. Increase in the probability of default of the issuer.

II. Decrease in risk premium.

III. Decrease in loss given default of the issuer.

IV. Increase in expected loss.

By lowering the spread on lower credit quality borrowers, the bank will typically achieve all of the following outcomes EXCEPT:

After entering the securitization business, Delta Bank increases its cash efficiency by selling off the lower risk portions of the portfolio credit risk. This process ___ return on equity for the bank, because the cash generated by the risk-transfer and the overall ___ of the bank's exposure to the risk.

Which one of the following four statements correctly defines chooser options?

What is generally true of the relationship between a bond's yield and it's time to maturity when the yield curve is upward sloping?

What is the explanation offered by the liquidity preference theory for the upward sloping yield curve shape?

ThetaBank has extended substantial financing to two mortgage companies, which these mortgage lenders use to finance their own lending. Individually, each of the mortgage companies have an exposure at default (EAD) of $20 million, with a loss given default (LGD) of 100%, and a probability of default of 10%. ThetaBank's risk department predicts the joint probability of default at 5%. If the default risk of these mortgage companies were modeled as independent risks, the actual probability would be underestimated by:

Which one of the following four variables of the Black-Scholes model is typically NOT known at a point in time?

Which one of the following four statements on the seniority of corporate bonds is incorrect?

According to a Moody's study, the most important drivers of the loss given default historically have been all of the following EXCEPT:

I. Debt type and seniority

II. Macroeconomic environment

III. Obligor asset type

IV. Recourse

Which one of the following four global markets for financial assets or instruments is widely believed to be the most liquid?

By foreign exchange market convention, spot foreign exchange transactions are to be exchanged at the spot date based on the following settlement rule:

Which of the following factors can cause obligors to default at the same time?

I. Obligors may be harmed by exposures to similar risk factors simultaneously.

II. Obligors may exhibit herd behavior.

III. Obligors may be subject to the sampling bias.

IV. Obligors may exhibit speculative bias.

Which one of the following four options is NOT a typical component of a currency swap?

All of the four following exotic options are path-independent options, EXCEPT:

Which one of the following statements about futures contracts is correct?

I. Futures contracts are subject to the same risks as the underlying instruments.

II. Futures contracts have additional interest rate risk die to the future delivery date.

III. Futures contracts traded in a clearinghouse system are exposed to credit risk with numerous counterparties.

After entering the securitization business, Delta Bank increases its cash efficiency by selling off the lower risk portions of the portfolio credit risk. This process ___ risk on the residual pieces of the credit portfolio, and as a result it ___ return on equity for the bank.

Which one of the following four formulas correctly identifies the expected loss for all credit instruments?

An asset manager for a large mutual fund is considering forward exchange positions traded in a clearinghouse system and needs to mitigate the risks created as a result of this operation. Which of the following risks will be created as a result of the forward exchange transaction?

The pricing of credit default swaps is a function of all of the following EXCEPT:

In the United States, foreign exchange derivative transactions typically occur between

According to the largest global poll of foreign exchange market participants, which one of the following four global financial institutions was the most active participant in the global foreign exchange market?

To safeguard its capital and obtain insurance if the borrowers cannot repay their loans, Gamma Bank accepts financial collateral to manage its credit risk and mitigate the effect of the borrowers' defaults. Gamma Bank will typically accept all of the following instruments as financial collateral EXCEPT?

Which one of the following four features is NOT a typical characteristic of futures contracts?

Gamma Bank is active in loan underwriting and securitization business, and given its collective credit exposure, it will be typically most interested in the following types of portfolio credit risk:

I. Expected loss

II. Duration

III. Unexpected loss

IV. Factor sensitivities

Which of the following risk types are historically associated with credit derivatives?

I. Documentation risk

II. Definition of credit events

III. Occurrence of credit events

IV. Enterprise risk

For which one of the following four reasons do corporate customers use foreign exchange derivatives?

I. To lock in the current value of foreign-denominated receivables

II. To lock in the current value of foreign-denominated payables

III. To lock in the value of expected future foreign-denominated receivables

IV. To lock in the value of expected future foreign-denominated payables

Alpha Bank determined that Delta Industrial Machinery Corporation has 2% change of default on a one-year no-payment of USD $1 million, including interest and principal repayment. The bank charges 3% interest rate spread to firms in the machinery industry, and the risk-free interest rate is 6%. Alpha Bank receives both interest and principal payments once at the end the year. Delta can only default at the end of the year. If Delta defaults, the bank expects to lose 50% of its promised payment.

What may happen to the Delta's initial credit parameter and the value of its loan if the machinery industry experiences adverse structural changes?

To manage its credit portfolio, Beta Bank can directly sell the following portfolio elements:

I. Bonds

II. Marketable loans

III. Credit card loans

Which one of the following four statements correctly defines a non-exotic call option?

In analyzing market option pricing dynamics, a risk manager evaluates option value changes throughout the entire trading day. Which of the following factors would most likely affect foreign exchange option values?

I. Change in the value of the underlying

II. Change in the perception of future volatility

III. Change in interest rates

IV. Passage of time

Which one of the following four model types would assign an obligor to an obligor class based on the risk characteristics of the borrower at the time the loan was originated and estimate the default probability based on the past default rate of the members of that particular class?

Which one of the following four statements about the relationship between exchange rates and option values is correct?

Which one of the following four options correctly identifies the core difference between bonds and loans?

All of the following performance statistics typically benefit country's creditworthiness EXCEPT:

Suppose Delta Bank enters into a number of long-term commercial and retail loans at fixed rate prevailing at the time the loans are originated. If the interest rates rise:

Which type of risk does a bank incur on loans that are in the "pipeline", i.e loans that are in the process of origination but not yet originated?

Arnold Wu owns a floating rate bond. He is concerned that the rates may fall in the future decreasing his payment amount. Which of the following instruments should he buy to hedge against the fall in interest rates?

Which one of the following four factors typically drives the pricing of wholesale products?

Bank G has a 1-year VaR of USD 20 million at 99% confidence level while bank H has a 1-year VaR of USD 10 million at 95% confidence level. Which bank is in a more risky position as measured by VaR?

Banks duration match their assets and liabilities to manage their interest risk in their banking book. Currently, the bank's assets and liabilities both have a duration of 10. To hedge against the risk of decreasing interest rates, the bank should

I. Increase the duration of the liabilities

II. Increase the duration of the assets

III. Decrease the duration of the liabilities

IV. Decrease the duration of the assets

Which one of the following inherent biases occurs in scenario analysis for operational risk?

Under Basel III, what is divided by Total Exposure to calculate the bank’s Leverage Ratio?

Which one of the following four statements describes the advantage of using delta-gamma method of mapping options positions over delta-normal method?

Delta-gamma method